At bonkers.ie we know that switching saves. And switching your mortgage can really save you money. So what are the steps involved in switching lender?

Your mortgage is likely to be your biggest household outgoing for years so this is one bill that you really don't want to overpay on! So just like any other bill, you should look into switching your mortgage every few years to ensure you’re not overpaying.

And an increasing number of people are doing just that.

According to the Banking & Payments Federation Ireland, over 7,000 people in Ireland switched mortgage lender in 2021. A record high and a 22% increase compared to 2020.

So how much could you save, is it an option for everyone, and what are the steps involved?

How much could I save by switching mortgage?

It depends on your individual circumsrances.

Someone who has a mortgage of €250,000 remaining over 20 years, who is currently paying a rate of 4.50%, and who has at least 20% equity in their home, could save over €100 a month by switching to the cheapest rate on the market.

That's not an insignificant amount of money.

And while there are some upfront costs associated with switching mortgage provider, in many cases banks will provide cashback to those who switch or a contribution towards the legal fees.

Is switching mortgage an option for everyone?

Each bank has its own set of criteria for accepting mortgage switchers and if your financial circumstances have changed dramatically for the worse since you qualified for your initial mortgage, you may have problems switching.

However if you look to switch mortgage and don't get accepted, your current lender won't treat you any differently. So there's no need to worry if you get rejected. Nothing ventured, nothing gained as they say!

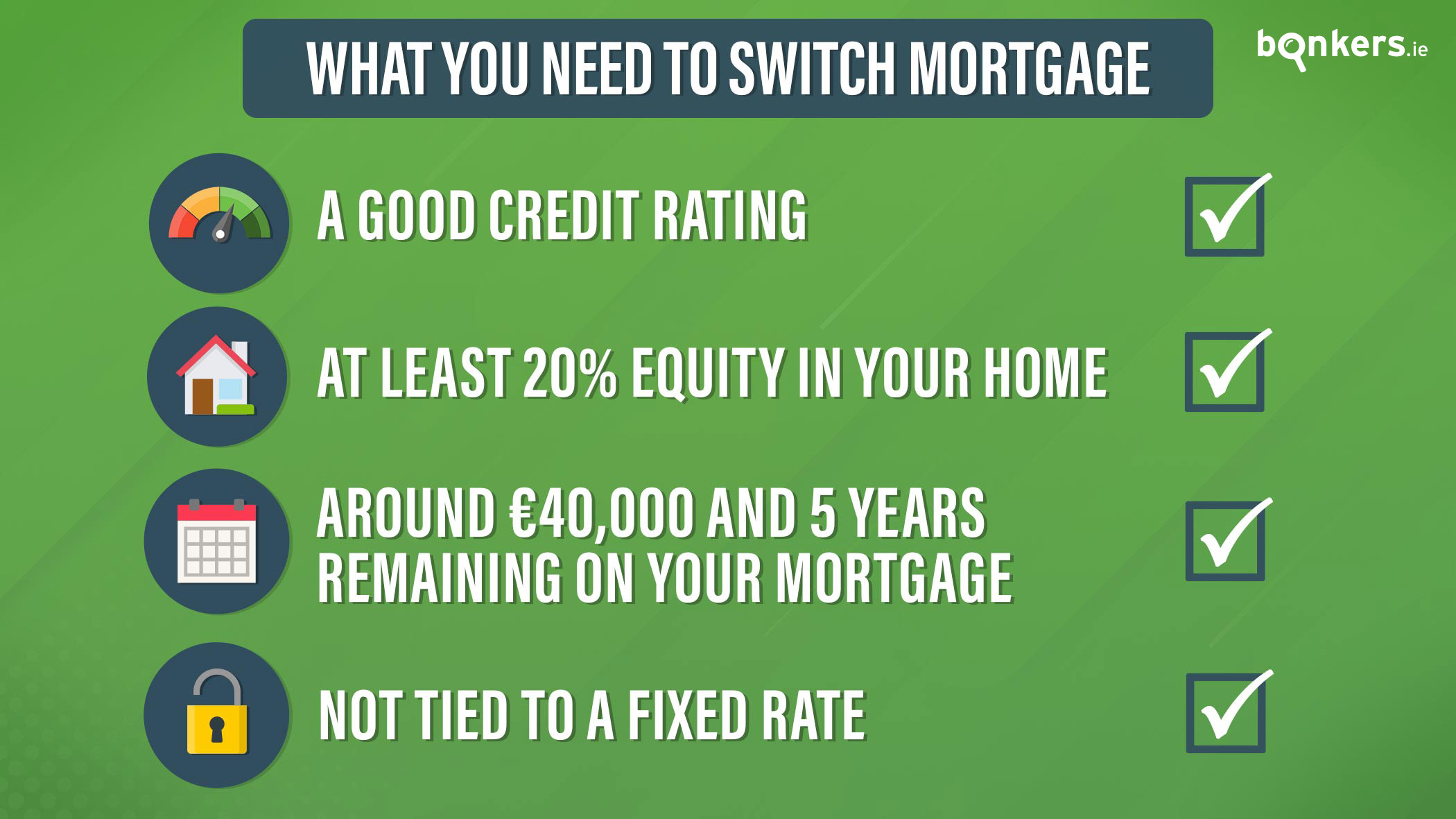

In general, before switching, you must consider factors such as:

- The outstanding balance on your mortgage. The minimum amount accepted by Irish lenders for someone switching is around €40,000 to €50,000. Anything less and the bank will feel it won't be worth its while.

- Whether you have a fixed-rate mortgage with your current lender. You may be charged a penalty fee for switching out of a fixed-rate mortgage early so you may need to wait until the end of the term before you can consider switching. However, sometimes the penalty for breaking a fixed-rate may be far less than the savings you'd make by switching mortgage lender so it's important to do the math.

- Your credit rating. You must still have a good credit rating. A credit check will be carried out by the lender you’re trying to switch to and if you’ve taken out new loans or used credit cards and had difficulties repaying these, you may have problems switching.

- How much equity is in your home. You may have difficulty switching if you are in negative equity or have less than 20%. However each lender will assess your switch on a case-by-case basis.

- The term remaining on your mortgage. You may not be able to switch if you only have a few years remaining on your mortgage as again the bank may feel it won't be worth the time.

- Your home. In rare cases the type of home you live in and its location can affect your ability to switch. People in homes with Granny Flats, particularly ones which are rented out, can have trouble switching for example.

Can I be penalised for switching mortgage provider?

As mentioned above you may have to pay a breakage fee if you're on a fixed rate and are looking to switch lender before it's due to end.

Other than this you cannot be penalised for looking to switch mortgage provider. This includes anyone who has gotten a 'cashback mortgage'.

If you received cashback as part of your original mortgage you do not have to pay any of this money back when switching.

You can learn more about cashback mortgages in this guide.

What are the steps involved in switching your mortgage?

- Know your current situation. Find out how much is still owed on your existing mortgage and the term remaining as your new lender will need to know this. And most importantly you need to find out the interest rate you’re currently paying. You can find all this information on a recent mortgage statement or by contacting your lender. You'll also need a rough estimate of how much your home is currently worth.

- Compare. With the above info to hand, compare mortgage rates on bonkers.ie to find out who's offering the best rates and whether it makes financial sense to switch. Our mortgage service lets you easily find the best interest rates, offers and cashback incentives from all of Ireland’s mortgage lenders and will quickly show you what your new monthly repayments would be.

- Start the switch. bonkers.ie now has an in-house mortgage broker service. This means we can talk to your new lender on your behalf and help you with your entire mortgage switch. Make sure you ask about any cashback incentives as many lenders offer money to help cover the legal costs of switching.

- The documents. Once you've chosen your new lender they'll issue you with a mortgage switching pack which you'll need to fill out. Remember that you'll need to provide documentation such as:

- Proof of identity: such as a copy of your passport.

- Proof of address: such as a recent household bill in your name. To be accepted most bills will need to be dated within the past three months.

- Proof of your income: usually at least three recent pay slips.

- Evidence of how you manage your money: you’ll be asked to provide a copy of your current account statement for the previous six months or so. If you have any loans or credit cards, you’ll need to provide statements for these also.

- Evidence of any savings you might have.

- Employment status: your new lender will want information and proof as to what type of employment contract you are on. For example, permanent, contract, full-time, part-time etc.

- House valuation. You'll need to get an up-to-date professional valuation of your home. This is so that your new lender knows how big your mortgage is in relation to the value of your home and therefore how much equity you have. The more equity the better. The fee will be around €150 and the lender you're looking to switch to will give you the name of an approved valuer to use.

- The legal bit. You'll need to get a solicitor on board to take care of conveyancing and any legal documents. In general the legal fees for switching mortgage are less than the fees for first-time buyers.

- Mortgage protection. If you decide to switch mortgage provider you don’t need to take out a new mortgage protection policy as long as the amount you borrow and the term of your mortgage remain the same. In this case you just have to contact your current insurance provider and get them to reassign your existing policy to your new lender. However this might be an opportune time to look at getting cheaper mortgage protection too.

- Direct debit. When your mortgage is approved, your lender will ask you to fill in a new direct debit form so your repayments can be collected from your bank account. Remember to cancel the direct debit with your previous lender to ensure no further payments are taken.

- Done. Welcome to a cheaper mortgage!

How long does it take to switch mortgage?

It usually takes takes between six to eight weeks to complete the switch. It’s important to keep this in mind if you're on a fixed rate and are approaching the end of the term if you don’t want to roll over onto a (higher) variable rate.

When is the best time of year to switch?

There’s no specific time that’s best to switch your mortgage. If your mortgage amount is more than four times your salary you will need a Central Bank exemption. In this case, earlier in the year is better as there will be more exemptions available.

Some months of the year are likely to be busier than others when looking to switch, which can slow the process down.

See our other guide for more information on the best time to switch your mortgage.

Get switching

The easiest money you'll ever earn is the money that you've saved as they say. And who wouldn't like some extra hard-earned cash in their pocket?

Head over to our mortgage service and start your switch today.

You can find the best rates, incentives and cashback offers from Ireland’s main lenders.

When it’s time to apply to switch your mortgage, you can submit an online enquiry through our free mortgage broker service and one of our experienced financial advisors will call you back to get your application started.

Our mortgage service is fully digital from start to finish, meaning everything can be carried out online from the comfort of your home.

Check out our other mortgage articles

Did you find this guide useful? If so you might enjoy some of our other mortgage-related articles:

- Learn how to get your mortgage with bonkers.ie in this guide.

- More people are opting for fixed rates over variable rates, however it’s important to understand the pros and cons of both.

- If you’re considering making energy-efficient improvements to your home, you could be eligible for a green mortgage.

You can stay up to date on all the latest mortgage news and tips with our blogs and guides pages

Need any help?

If you have any questions about the mortgage switching process, feel free to get in touch with us. You can contact us on Facebook, Twitter or Instagram.

.jpg)