The number of people switching their mortgage in Ireland is at a record high and in 2021 over 7,200 people switched lender. And although there are fees with switching, there are also big savings to be made and many lenders will provide cashback to help with the costs too.

According to the Central Bank of Ireland, there are "significant sums of money" to be saved by switching mortgage.

Indeed, someone paying a 4% rate who has €200,000 remaining on their mortgage over 20 years, could save over €130 a month at present if they switched to Permanent TSB's 2.70% four-year fixed rate, for example.

That's a saving of over €6,000 over just four years!

Are there any barriers to switching mortgage provider?

Well, switching can feel a bit daunting, particularly when it comes to something as important as your mortgage. Then there’s the paperwork that's involved. And significantly, there’s also the cost.

However many lenders now offers sizeable cashback incentives to encourage people to switch, which in many cases will more than offset the legal fees.

So, let’s take a closer look at those fees, see what they’re for and find out how much they’ll cost you.

Why do I need to pay legal fees to switch mortgage providers?

If you decide to switch mortgage providers, you must employ a solicitor to take care of the processing, paperwork and liaising. Thankfully, when it comes to switching, the cost and workload for the solicitor is about half of what it is when buying a new property.

Most of your legal costs will go on your solicitor’s professional fee, with some extra euro going towards his/her outlays, associated costs and, of course, VAT. Here’s a summary of what they’ll do for their fee:

1. First, your solicitor will request the deeds to your home from your old bank and act as the point of contact with your new bank for the switching process.

2. Your solicitor will then invite you in for a consultation to go through the loan offer from your new bank and to advise on any questions or concerns you might have.

3. If you’re happy to proceed with the switch, you’ll sign a new loan agreement, which your solicitor will send to your new bank. If you wish to add a new name to the title deeds of your home, your solicitor can help with that too.

4. Once there’s a legally-binding contract in place, your solicitor will continue to deal with your new bank (and a broker, if there’s one involved) until your loan cheque is issued.

How much can I expect my legal fees to be?

All in, legal fees for switching mortgage provider should amount to somewhere between €1,200 and €1,500 plus VAT at 23%. The land registry fee, which you would have paid as a first-time buyer, and which can be several hundred euro, won't be incurred again.

Although not strictly a legal fee, there is always a valuation fee associated with switching mortgage too, which will cost you around €150.

Which banks will cover my legal fees when I switch?

Due to a lack of housing supply and the difficulties many people have saving for a mortgage deposit, the number of first-time buyers is still somewhat below what it was at the peak of the boom. To make up for this shortfall in business, many lenders are actively targeting switchers and most now offer to cover some or all of the legal fees to encourage borrowers to move to them.

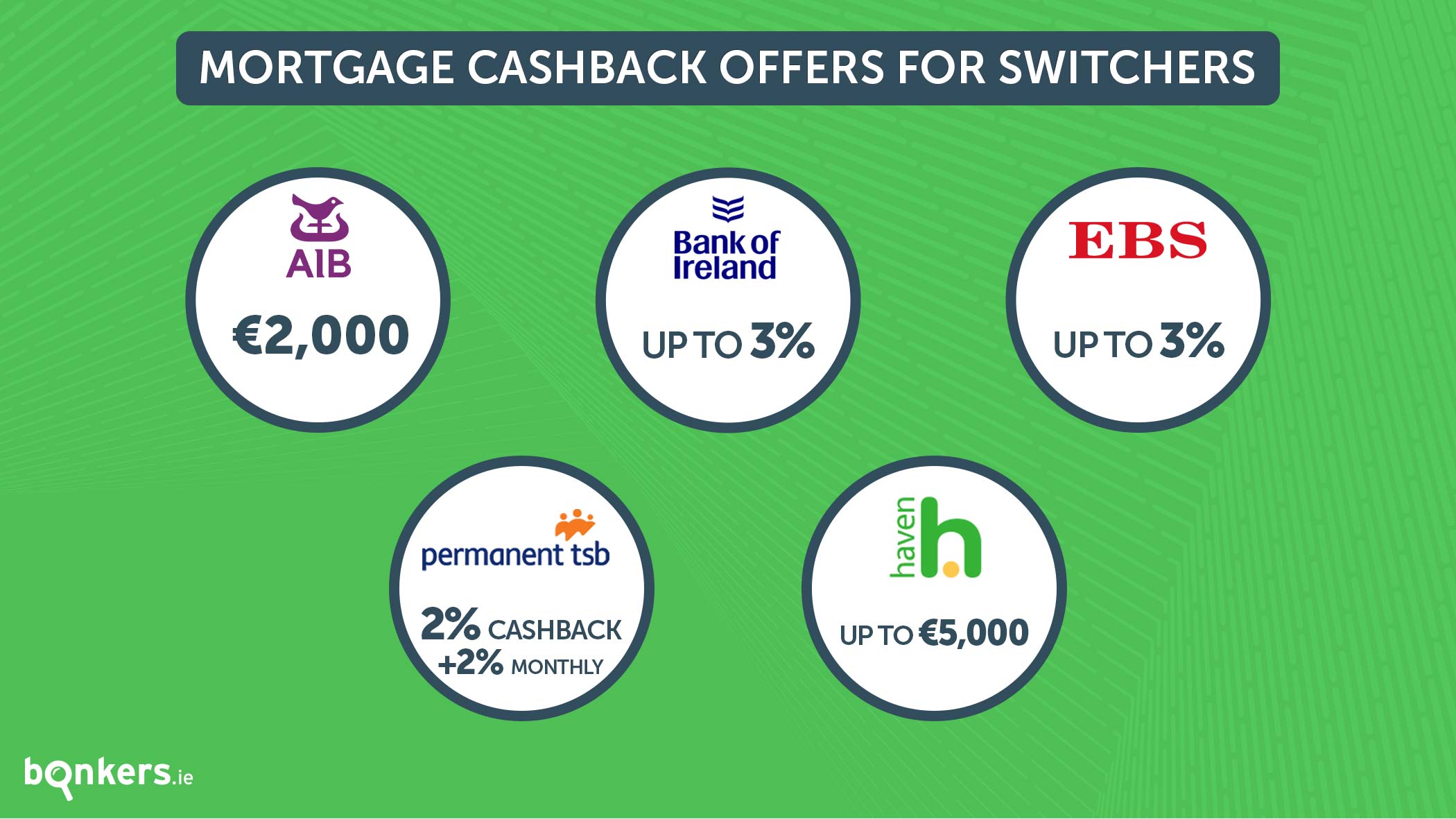

So here’s what’s on offer:

AIB - €2,000

To help cover your switching costs, AIB will pay you a flat €2,000 lump sum.

Bank of Ireland – up to 3% cashback

If you switch your mortgage to Bank of Ireland you’ll receive an unlimited 2% cashback on the total value of your mortgage.

So, if you have €200,000 left on your mortgage and you switch to Bank of Ireland, you’ll get €4,000 back in cash upfront. That will more than cover your legal fees and leave you with enough for a nice trip away.

If you are a Bank of Ireland current account customer, you'll get an additional 1% of the mortgage amount back in cash after five years (subject to meeting the terms of the mortgage).

However BOI's 2.15% four-year 'green' fixed rate - its lowest rate on offer - doesn't come with any cashback.

EBS - up to 3% cashback

Switch your mortgage to EBS and you’ll get 2% cashback on your mortgage at drawdown and an additional 1% cashback in five years' time. Unlike BOI, there's no need to have a current account with EBS to get this additional 1%.

However no cashback is available with its new 'green' mortgage.

Haven - up to €5,000

Haven has two cashback offers at present: a €2,000 offer available with its low-rate 'green' mortgage, and a €5,000 offer for people switching a mortgage of at least €250,000 and who choose a fixed rate.

Permanent TSB - 2% cashback

Switch mortgage to Permanent TSB and you’ll get 2% cashback on your mortgage at drawdown and also 2% cashback on each of your monthly mortgage repayments every month until 2027 when you pay from its Explore Account.

However Permanent TSB's 2.70% fixed rate over four years - its lowest rate on offer - doesn't come with any cashback.

Who can switch mortgage?

Each bank has its own set of criteria for mortgage switchers and if your financial circumstances have changed for the worse since you qualified for your initial mortgage, you may have problems switching.

In general you also need to have around at least €40,000 to €50,000 remaining on your mortgage before a lender will consider your application. You also can’t switch if you're in negative equity. And ideally you should have at least 20%.

See our guide on how to switch your mortgage for more info on the process.

Can I switch mortgage provider if I took a cashback offer?

Although the banks won't be willing to admit it upfront, you can switch mortgage provider at any stage even if you've received cashback from your bank.

This is because under the EU's Mortgage Credit Directive from 2014, a bank can't seek to claw back any cash that it's paid out as part of your mortgage.

So theoretically, if you take out a mortgage with any of the above lenders, there's nothing to stop you switching to another lender in a few years' times without being penalised. However, if you take out a fixed-rate mortgage, you may need to wait until the end of the fixed-rate period, otherwise you could be charged a breakage fee.

Mortgage interest rates are where the real savings lie

While the prospect of having all switching legal fees covered is enticing, in most cases it is the interest rate on offer that will determine whether or not switching mortgage will save you money over the remainder of your loan.

Quite often, the lenders pr deals which offer some of the lowest rates and therefore the best longer-term value, offer no cashback at all.

If you're thinking of switching, our mortgage calculator will help you determine where your best long-term options lie.

Then if you decide to make the switch, you can submit an online enquiry through our new mortgage broker service and one of our experienced financial advisors will call you back to get your application started.

Our mortgage service is entirely free and is fully digital from start to finish, meaning everything can be carried out online from the comfort of your home. And it's completely paper-free too!

To find out more about our mortgage broker service, see here.

Get in touch!

Do you have any questions about switching mortgages? We’d be happy to help! Comment below or reach out to us on social media. We’re on Facebook, Twitter and Instagram.

.jpg)

.png)

.jpg)